Investment strategies Investing in private markets

Key things to know

Private markets include funds investing in private equity, real estate, private debt, infrastructure, and natural resources.

Benefits of private market investing may include higher return potentials, diversification beyond public markets, and access to unique opportunities.

Risks may include illiquidity of invested assets, long-term binding commitments of 10 or more years, and higher costs to invest.

Investing in private markets has long been the domain of institutional investors due to sophistication, access issues, complexity and illiquidity. Institutional investors, including family offices, endowments, foundations and pension plans, find certain types of investment opportunities available only through private markets.

However, qualified individual clients1 looking for the opportunity for long-term portfolio growth, and who are comfortable with illiquid investments and who can tolerate the additional risk associated with investing in private markets, may want to consider an allocation to this asset class.

The first step in assessing whether private investing might be a way to achieve your long-term financial goals is to learn more about it. Below, we look at the potential opportunities and risks to help you make an informed decision.

Overview of private markets

Private market investing involves investing in non-public companies through off-exchange, negotiated transactions. Private markets include funds investing in private equity, real estate, private debt, infrastructure and natural resources. Private equity comprises most of the investments in private markets, such as financing start-up companies, providing growth capital for fast-growing businesses, and buying mature public or private companies.

Private market investments differ from public market investments in many ways. At a high level, the latter involves the use of shorter-term investments and publicly available information. Private market investments, on the other hand, often require:

- Long-term commitment and lack of liquidity

- Greater governance and active business growth value-add

- Closely held and protected private company information

- Patient/long-term capital

- Use of leverage

Common private market investing strategies

Each private marketing investment strategy provides a different type of risk exposure and return experience. Some of the most common include:

- Venture capital: Include seed, early stage and late-stage investments, are usually made as equity or equity-like investments and have the highest risk/return profile of the private equity asset class.

- Growth capital: Include revenue-generating, high-growth companies which can provide a more stable risk/return profile.

- Buyouts: acquiring a controlling equity interest in more seasoned companies that generate more stable and predictable cash flows. This can reduce the risk of investing. Investors usually employ debt capital, acquire a majority ownership stake, and implement growth strategies and operational enhancements to add-value to the company.

- Special situations: Include investing in distressed, illiquid debt securities, business turnarounds, secondary transactions and other complex situations. Risk/return varies significantly depending on the situation.

- Private debt: Senior secured or mezzanine debt investments in private companies can provide an alternative source of income. Risk varies depending on the seniority of the debt and stage of the company.

- Real assets: Investing in real estate or other real assets, such as infrastructure or farmland, opens up the possibility of asset appreciation and income earned from the use of the asset. Again, risk varies.

Private market investments differ depending on the stage of a company’s life cycle, the health of the business, and the underlying asset class.

Investing in private markets brings the potential for both outperformance and portfolio diversification benefits relative to investing in a traditional stock and bond portfolio.

Benefits of private market investing

Investing in private markets brings the potential for both outperformance and portfolio diversification benefits relative to investing in a traditional stock bond portfolio. These potential benefits include:

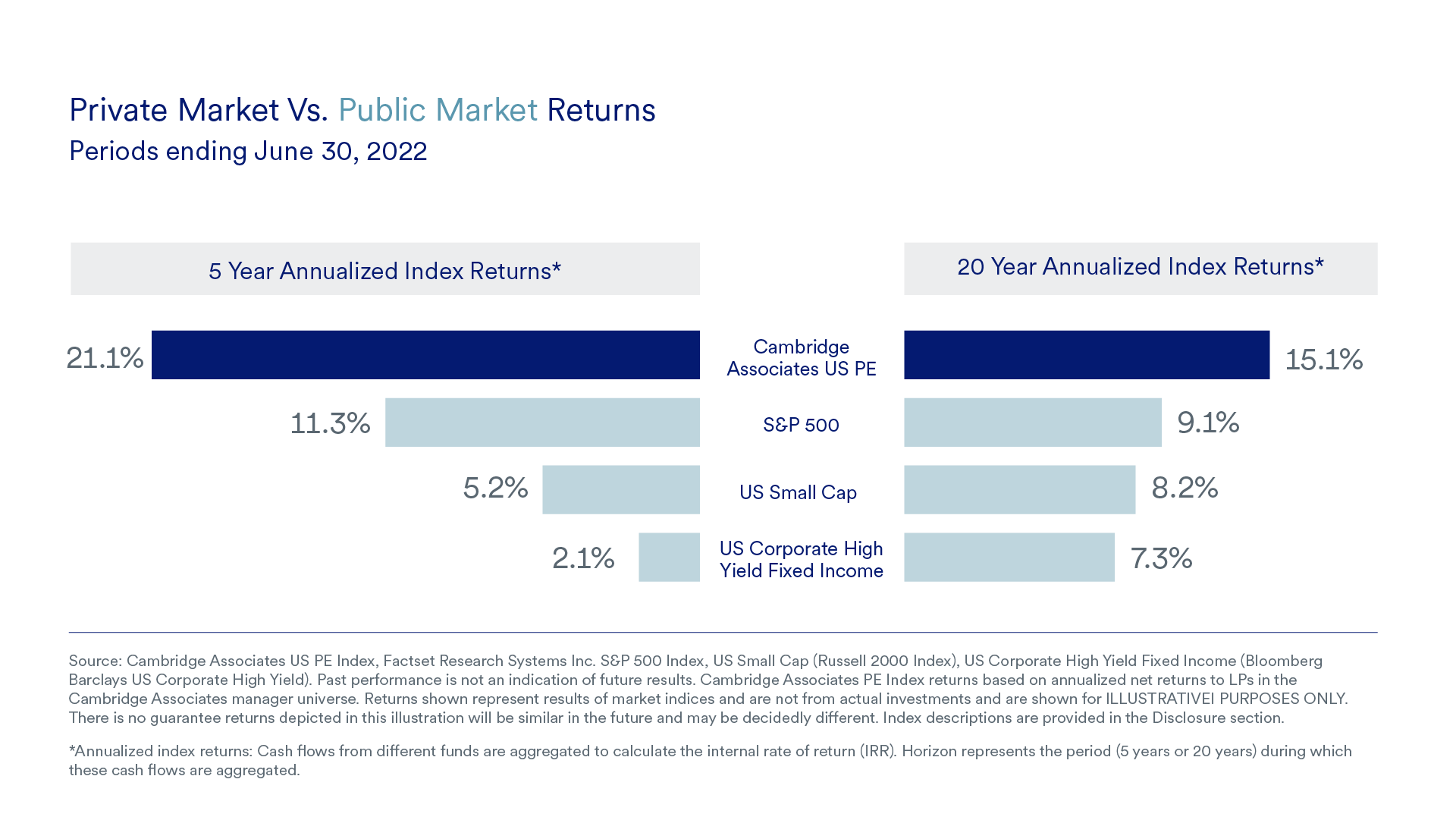

Higher return potential: Private markets have outperformed stocks and bonds during both 5-year and 20-year periods by 5.2% and 6.7%, respectively, on an annualized return basis, as show in the charts below.

- Diversification: Private investing provides access to different segments of the markets not available through traditional stock and bond investing. For example, the venture capital sector allows investors to fund innovative companies that may have the highest return potential, albeit at a higher risk of capital loss.

- Access to unique opportunities: A buyout, for example, gives an investor the chance to participate in the long-term transformation of a business. It could range from a solid underlying company that needs expert help to boost value to a struggling company that needs substantial investment of time and resources from an expert manager who understands complex bankruptcy laws.

Risks with private market investing

Compared with public market investing, the risks of private market investing can be difficult to assess given the lack of easily accessible information, differences in private market managers’ experience, and the illiquid nature of this type of investing.

Some of the key risks of private investing to consider include:

- Illiquidity: Private market funds, generally structured as a limited partnerships, are illiquid relative to other investments, such as a mutual fund, that invests in public market securities and has daily liquidity. An investor should only consider private market funds if they’re comfortable with holding the investment through the life of the fund which could be ten years or longer. Limited partnership interest sales, if they can be executed, generally occur at deep discounts to net asset values in the secondary market.2

- Long-term binding commitments: Commitments made to a private market manager are legally binding through the terms of the limited partnership agreement. Limited partners must honor capital commitments to a fund even if the fund manager is underperforming. Investors may seek to influence the strategy of underperforming managers through advisory boards and/or their contractual rights as outlined in the limited partnership agreement of the fund.

- High costs: Private market funds have higher costs compared with public market mutual funds. Typically, private market funds charge a management fee and a performance fee. They also pass on costs related to setting up the partnership structure. Managers with unique expertise that results in generating attractive returns through value-add activities may help justify the higher costs.

- Speculative: Private market funds may use speculative investment techniques, concentrated portfolios, control and non-control positions, and illiquid investments. It’s not guaranteed that a private market fund will deliver the expected returns and there is also a potential risk of substantial, or total, loss of capital.

How to invest in private markets

Investors can access private markets by investing directly in private companies or by investing through commingled private market funds. Limited partnerships are typically formed for investing in commingled funds and make direct investments in companies or other funds. A fund of funds, which is a commingled fund vehicle that invests in other funds, is one example of this.

An important consideration when investing in private markets is manager selection. It takes deep expertise to identify good opportunities and there is a wide variability in performance outcomes between good and not so good managers. Investors committing to a private market fund are committing to a team of professionals. In many cases, private market investing is “blind pool” investing because the investor does not know the composition of the portfolio until after the funds have been raised.

Private market investments can play an important role in portfolio diversification and can offer attractive absolute and risk-adjusted returns over the long term. Investors should be careful, however, due to identified risks, variations in private market manager experience and the illiquid nature of this type of investment. An experienced and diligent private markets team can help individual investors navigate the landscape and identify appropriate high-potential opportunities traditionally available only to institutional investors.

Ascent Private Capital Management of U.S. Bank provides Investment Management, Investment Consulting and Investment Monitoring for clients with complicated investment scenarios. Learn more.

Based on our strategic approach to creating diversified portfolios, guidelines are in place concerning the construction of portfolios and how investments should be allocated to specific asset classes based on client goals, objectives and tolerance for risk. Not all recommended asset classes will be suitable for every portfolio. Diversification and asset allocation do not guarantee returns or protect against losses.

Past performance is no guarantee of future results. All performance data, while obtained from sources deemed to be reliable, are not guaranteed for accuracy. Indexes shown are unmanaged and are not available for direct investment. The S&P 500 Index consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. The Bloomberg Barclays Government/Credit Bond Index is composed of U.S. dollar-denominated government, government-related and investment-grade U.S. corporate bonds. The Cambridge Associates U.S. Buyout & Growth Equity Index and benchmark statistics are based on data compiled from more than 2,100 institutional-quality global buyout and growth equity funds formed between 1986 and 2018. Private indexes are pooled horizon internal rate of return (IRR) calculations, net of fees, expenses, and carried interest. The timing and magnitude of fund cash flows are integral to the IRR performance calculation. Public indexes are average annual compounded return (AACR) calculations which are time weighted measures over the specified time horizon and are shown for reference and directional purposes only. The Cambridge U.S. Private Equity Index is based on returns data compiled for U.S. private equity funds (including buyout, growth equity and mezzanine funds) that represent the majority of institutional capital raised by private equity partnerships formed since 1986. The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index and is representative of the U.S. large capitalization securities market. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index and is representative of the U.S. small capitalization securities market.

The simulated performance for the time periods shown reflect the back-tested, historical returns from identified indices that would have been earned had the strategy been fully developed and implemented at the inception date. Performance information for the comparisons is hypothetical and shown for illustrative purposes only. Performance shown was calculated using a model and does not represent actual returns achieved by any investor. The model portfolio results reflect a specific market environment and time period. Markets vary over time and under different market conditions, the models may produce different results. The portfolio’s hypothetical returns rely on a number of assumptions. No representation or warranty is made as to the reasonableness of the assumptions made or that all assumptions used in achieving the returns have been stated or fully considered. Changes in the assumptions may have a material impact on the model portfolio returns presented. Backward looking performance: based on “back-tested” performance information. Back testing involves applying an investment strategy (sometimes referred to as an algorithm or model) to past market conditions to show how the strategy may have performed if it had existed or been in operation then. Back testing does not portray actual performance. Backward looking performance cannot predict how an investment strategy will perform in the future.

International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments. Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility. Equity securities are subject to stock market fluctuations that occur in response to economic and business developments. The value of large-capitalization stocks will rise and fall in response to the activities of the company that issued them, general market conditions and/or economic conditions. Stocks of small-capitalization companies involve substantial risk. These stocks historically have experienced greater price volatility than stocks of larger companies and may be expected to do so in the future. Investments in fixed income securities are subject to various risks, including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Investment in fixed income securities typically decrease in value when interest rates rise. This risk is usually greater for longer term securities. Investments in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. There are special risks associated with investments in real assets such as commodities and real estate securities. For commodities, risks may include market price fluctuations, regulatory changes, interest rate changes, credit risk, economic changes and the impact of adverse political or financial factors. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates and risks related to renting properties (such as rental defaults). Mutual fund investing involves risk and principal loss is possible. Investing in certain funds involves special risks, such as those related to investments in small- and mid-capitalization stocks, foreign, debt and high-yield securities and funds that focus their investments in a particular industry. Please refer to the fund prospectus for additional details pertaining to these risks. Alternative investments very often use speculative investment and trading strategies. There is no guarantee that the investment program will be successful. Alternative investments are designed only for investors who are able to tolerate the full loss of an investment. These products are not suitable for every investor even if the investor does meet the financial requirements. It is important to consult with your investment professional to determine how these investments might fit your asset allocation, risk profile and tax situation. Private capital investment funds are speculative and involve a higher degree of risk. These investments usually involve a substantially more complicated set of investment strategies than traditional investments in stocks or bonds, including the risks of using derivatives, leverage, and short sales, which can magnify potential losses or gains. Always refer to a Fund’s most current offering documents for a more thorough discussion of risks and other specific characteristics associated with investing in private capital and impact investment funds. Private debt investments may be either direct or indirect and are subject to significant risks, including the possibility of default, limited liquidity and the infrequent availability of independent credit ratings for private companies. Private equity investments provide investors and funds the potential to invest directly into private companies or participate in buyouts of public companies that result in a delisting of the public equity. Investors considering an investment in private equity must be fully aware that these investments are illiquid by nature, typically represent a long-term binding commitment and are not readily marketable. The valuation procedures for these holdings are often subjective in nature.

Request a call.

Let’s start a conversation. Please request a call and an Ascent wealth management professional will contact you shortly.

Find an office.

Ascent’s regional team locations across the U.S. offer personalized support and a full suite of wealth management services.