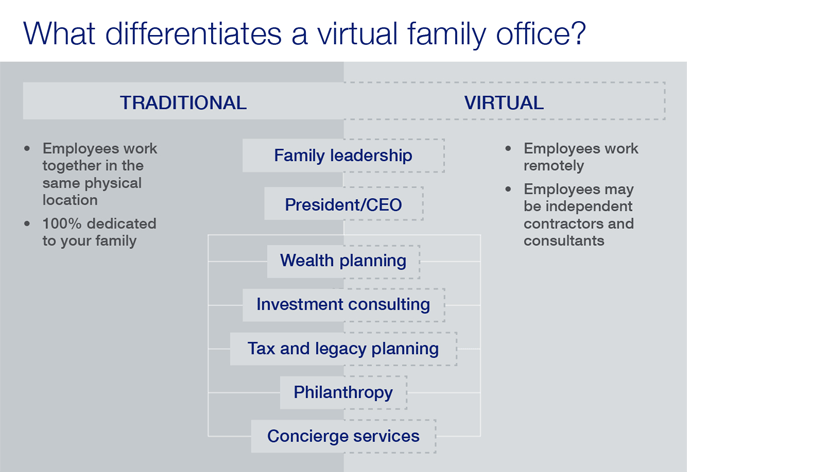

Virtual family offices are a hybrid of the single family office

Losey says virtual family offices are best understood as a type of single-family office.

“Single-family offices may be comprised of fewer or more virtual resources as they move along a continuum. Somewhere along the spectrum, as more and more resources are virtual, it will be obvious you are employing a “virtual” model,” says Losey.

But even traditional single-family offices use some aspects of the virtual family office model. For example, very few single-family offices have full-time attorneys on staff; instead, they hire outside legal expertise as needed.

In contrast, the virtual family office is less identified with the multi-family office model because most forms of multi-family offices already are “virtual” to the family—with all resources outsourced and virtual, including family office leadership.

Is a virtual family office right for your family?

Various factors will point you toward one or the other family office models. If control is a high priority, a single-family office will be preferred to multi-family. For single family offices exploring whether to be largely virtual, various factors will point toward or against local or virtual resourcing, including:

- Availability and expertise of local talent

- Degree of required specialization

- Amount of hands-on services required

- Importance of personal relationship/trust between resources and family

- Relative costs of virtual vs. local resources

“And understand, it is rarely an all-or-nothing equation. Some family offices look very traditional with most resources on staff, but with certain resources outsourced virtually,” says Losey. “On the other end of the spectrum, you have family offices with just one full-time employee, usually the CEO, working off a hub-and-spoke model where the spokes are virtual resources.”

Benefits and challenges of virtual family offices

Virtual family offices offer other potential benefits in addition to lower cost. For example, families aren’t limited to people who live in the immediate area when hiring experts and specialists to handle tasks like investment management, accounting, and tax and legacy planning.

“The world is at your disposal,” says Losey. “You can hire the best experts, regardless of where they’re located, which is especially important if you have very specific needs.”

Virtual family office hubs also offer more flexibility. Instead of a fixed staff of full-time employees and the associated costs (such as salaries, benefits and rent), families benefit from a flexible group of remote contractors and consultants who can more easily be added to and subtracted from the team as needed. This makes it easier for families to respond quickly to changes in the market and internal family dynamics.

“Efficiencies are built into the virtual family office model,” says Losey.

However, resource turnover can be more challenging with a virtual family office than with traditional family office.

“Virtual family office contractors and consultants aren’t 100% dedicated to your family like full-time family office employees are,” says Losey. That means it’s easier for them to leave for a better opportunity, which could leave your family office without expertise in a key area until you find a replacement.

There’s also the potential for “silos” in virtual family offices since contractors and consultants aren’t interacting face-to-face every day. This can potentially lead to miscommunication, misunderstandings, inefficiencies, and lost opportunities in virtual family office services.

“Strong leadership and communication by the president/CEO are critical to virtual family office success,” Losey says.

Depending on your situation, a virtual family office might make sense for your family. Your wealth advisor can help you make the right decision based on your needs.

Learn how Ascent Private Capital Management can work with and support your family office.